Irs Form 1040 Schedule 3 2024 – But last year, the IRS delayed the $600 tax reporting rule for payment apps, meaning that similar to prior years, users of cash apps would only receive a 1099-K tax form if they made $ threshold . One place you can start your advance tax planning is with the standard deduction amounts for 2024. Fortunately, the IRS has already released the standard deduction amounts for the 2024 tax year. The .

Irs Form 1040 Schedule 3 2024

Source : tuition.asu.edu

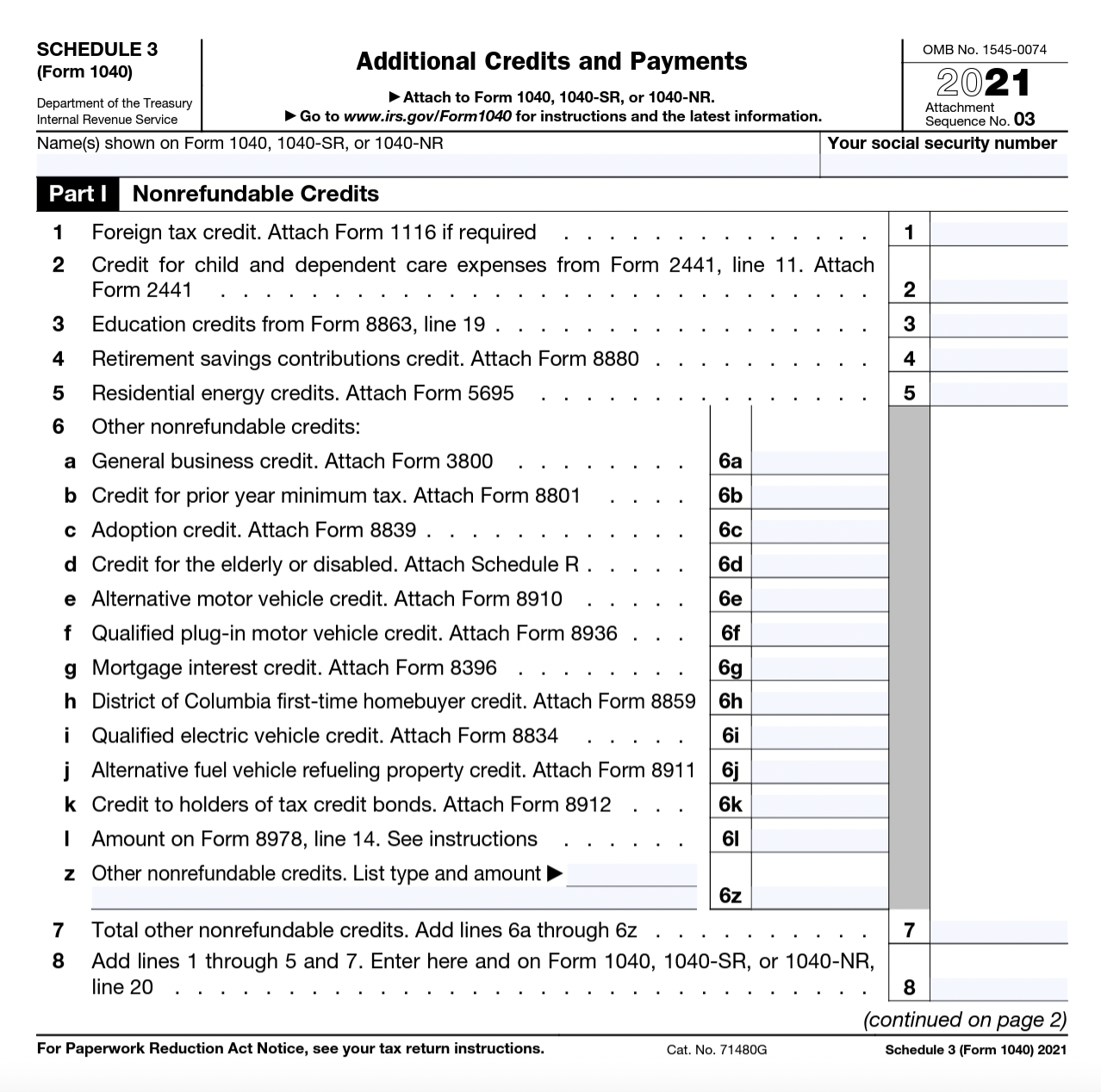

What is IRS Form 1040 Schedule 3? TurboTax Tax Tips & Videos

Source : turbotax.intuit.com

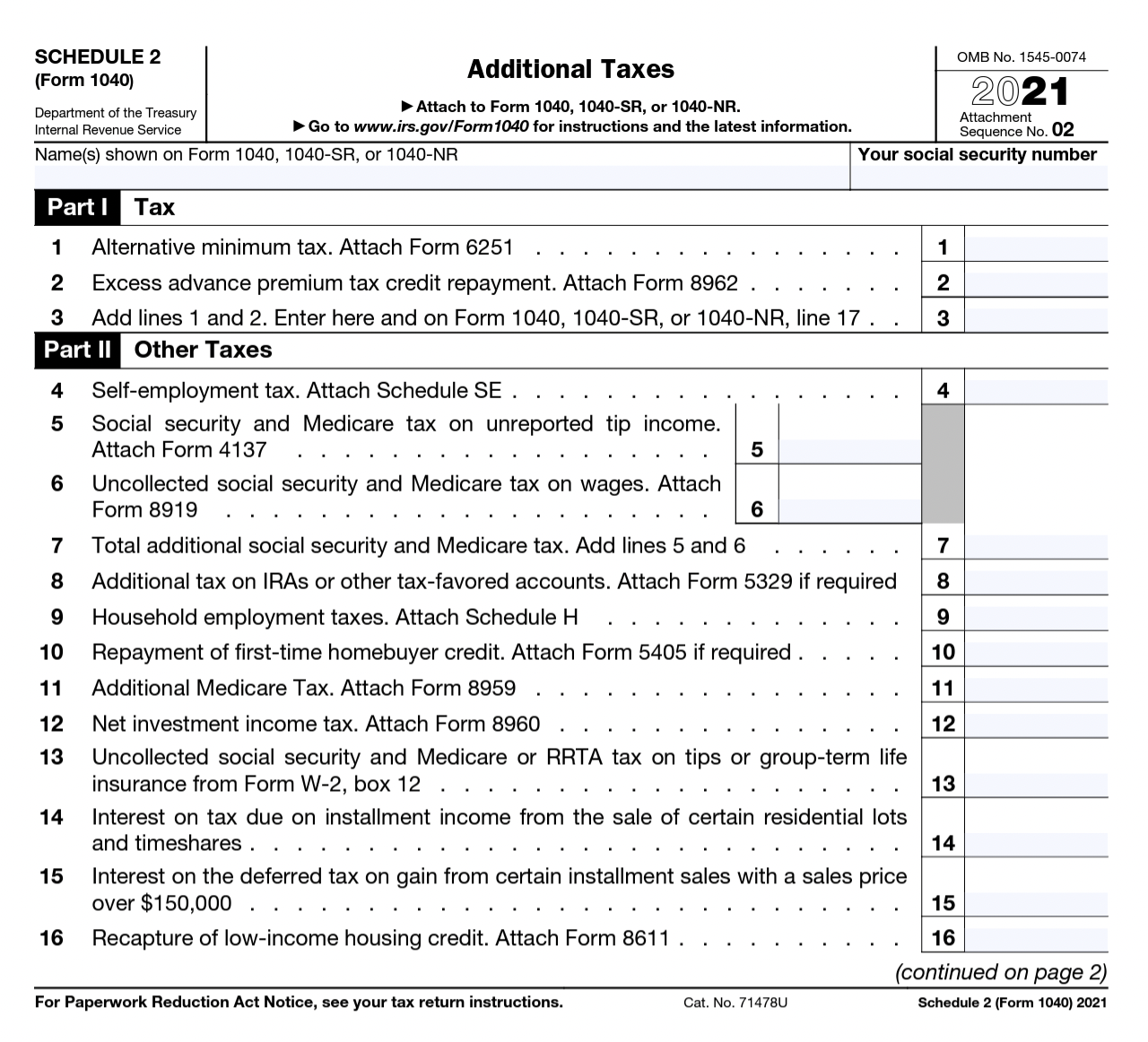

Publication 505 (2023), Tax Withholding and Estimated Tax

Source : www.irs.gov

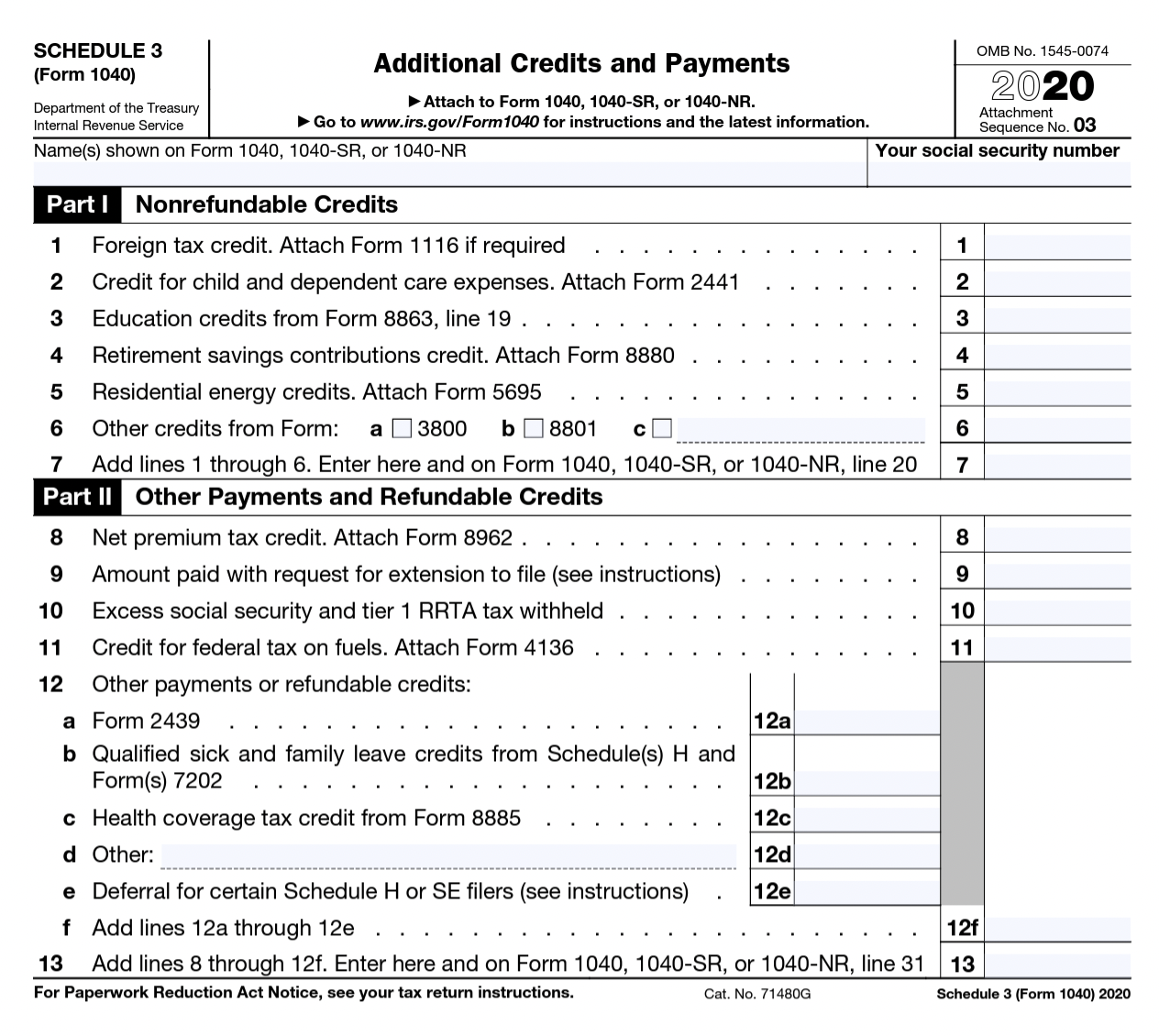

IRS Schedule 3 walkthrough (Additional Credits & Payments) YouTube

Source : m.youtube.com

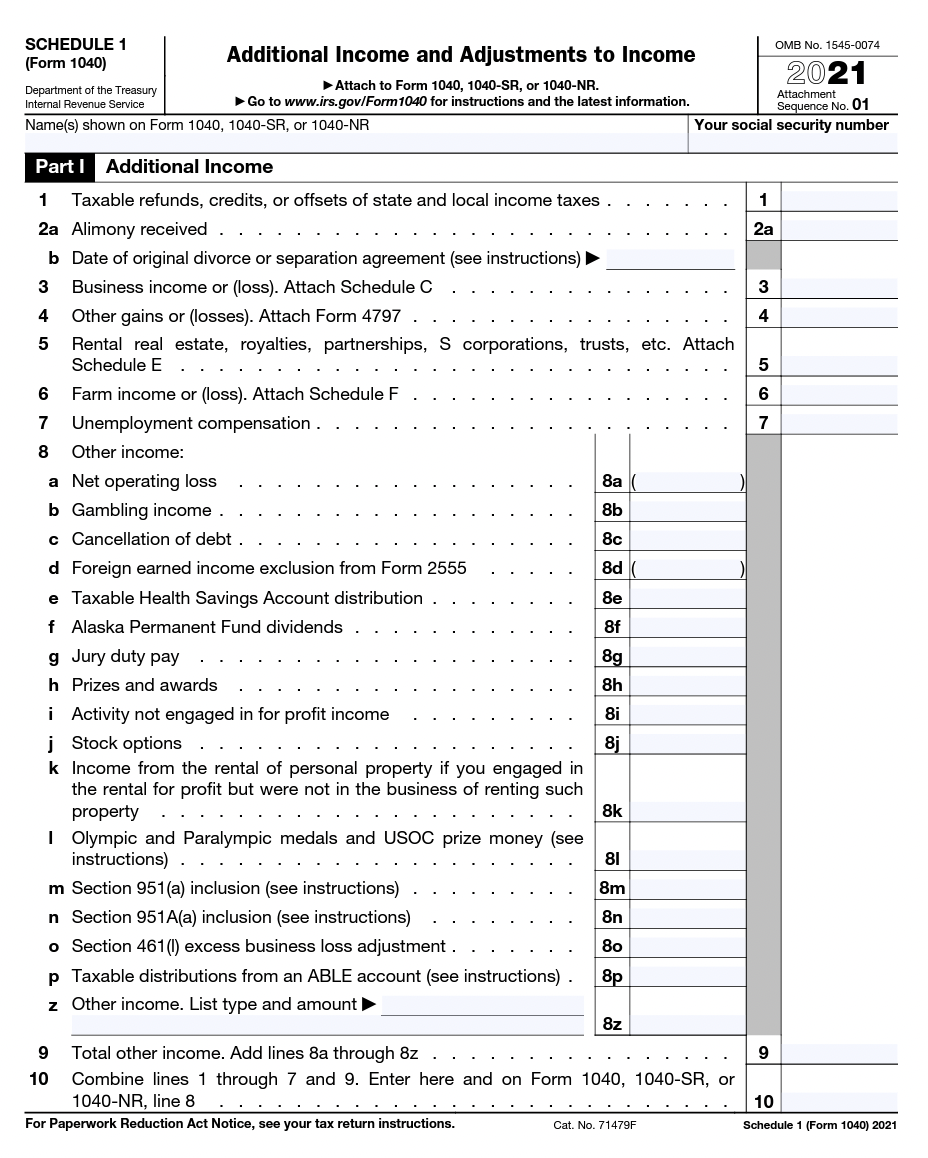

Most commonly requested tax forms | Tuition | ASU

Source : tuition.asu.edu

3.11.13 Employment Tax Returns | Internal Revenue Service

Source : www.irs.gov

Most commonly requested tax forms | Tuition | ASU

Source : tuition.asu.edu

3.11.13 Employment Tax Returns | Internal Revenue Service

Source : www.irs.gov

Most commonly requested tax forms | Tuition | ASU

Source : tuition.asu.edu

3.11.13 Employment Tax Returns | Internal Revenue Service

Source : www.irs.gov

Irs Form 1040 Schedule 3 2024 Most commonly requested tax forms | Tuition | ASU: Taxpayers and gig workers who use apps such as Venmo and Paypal to make money selling personal goods and services don’t have to worry about the new $600 threshold for reporting sales on form . There are certain things you can do—at tax time and throughout the year—to maximize your tax benefits and minimize your taxes due. Here are our 10 top tips. .